Irs Phone Number Nj For Child Tax Credit

Heres The IRS Phone Number. 30 to make possible changes if you want. What else can I use for help.

How Do I Find A Good Irs Tax Attorney

Youd have until 1159 pm.

Individuals 800-829-1040 7 am. Head to the new Child Tax Credit Update Portal and click the Manage Advance Payments button.

Irs phone number nj for child tax credit. Be sure to include all requested documents and a copy of any notice s and letter s you received from the Division of Taxation. Local time Monday thru Friday. Given us your information in 2020 to receive the Economic Impact Payment with the Non-Filers.

Estate and gift taxes Form 706709 866-699-4083 8 am. Phone lines in Puerto Rico are open from 8 am. At time of publication the IRS is not accepting phone calls for information regarding the Child Tax Credit.

Do not call the IRS. To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment. The IRS said it will be offering families the ability to add children born or adopted in 2021 to its Child Tax Credit Update Portal.

Well issue the first advance payment on July 15 2021. Enter an email address you can access and choose a password. New Jersey Division of Taxation.

Having trouble with the website. This is not a new credit although it has been increased by the American Rescue Plan. Calculation of Advance Child Tax Credit Payments.

Note that if youre married and file taxes jointly both spouses have to opt out individually. Our phone assistors dont have information beyond whats available on IRSgov. Here are a few child tax credit numbers to keep in mind.

To unenroll all youve got to do is navigate to the Child Tax Credit Update Portal and enter your personal information. The IRS has a Child Tax Credit Update Portal at IRSgov. To qualify for advance payments of the Child Tax Credit you and your spouse if you filed a joint return must have.

Then click Create account. Navigate to the IRS Child Tax Credit Update Portal CTC UP and select Create an account with IDme. Non-profit taxes 877-829-5500 8 am.

Select Continue to use your IDme account to access IRS. Depending on their income level and childs age families can receive monthly payments of up to 300 per kid in 2021 starting July 15. The new IRS tools help families determine if they are eligible for the up to 3600-per-child tax credits and opt out of the up to 300 monthly payments.

Enter Payment Info Here tool or. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. The latest tweets from irsnews.

The IRS said new monthly child tax. The maximum amount of the child tax credit per qualifying child. Otherwise the enrolled taxpayer will get half of the.

Before you ring its important to have your Social Security number date of birth and filing status nearby. If you need help please call our Customer Service Center at 609 292-6400. Taxpayers are getting a monthly advance on child tax.

You can visit IRSgovchildtaxcredit2021 for details. The number to dial is 800-829-1040 if you have an issue with your child tax credit payment. Parents can get up to 300 each month for each child under age 6 and up to 250 a month for each kid aged 6 to 17.

The main IRS phone number is 800-829-1040 but thats not the only IRS number you can call for help or to speak to a live person. If you wish not to continue you will not be. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or.

The maximum amount of the credit for other dependents for each qualifying dependent who isnt eligible to be claimed for the child tax credit. Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit. Under the American Rescue Plan ARPA millions of families will receive advance Child Tax Credit CTC payments of up to 300 per month per child under age 6 and 250 per month per child ages 6 through 17.

On the next page sign in using your IRS or IDme account. You can also opt out by calling the IRS phone number at 800-829-1040. Click the checkbox to accept IDmes terms and conditions and privacy policy.

The IRS telephone number is 1-800-829-1040 and they are available from 7 am. The maximum amount of the child tax credit per qualifying child that can be refunded even if the taxpayer owes no tax. The agency announced Wednesday that it upgraded the child tax credit update portal on IRSgov an application created after the American Rescue Plan became law in March.

Calculation of the 2021 Child Tax Credit. Child tax credit up to 300 a month coming July 15 IRS announces Updated. 3600 child tax credit payments.

18 2021 608 am. Businesses 800-829-4933 7 am. Heres a list of other IRS phone numbers to try so you can reach.

15 but the millions of payments the IRS has sent out have not been without trouble. The advance payments of the Child Tax Credit are well underway with the third payment to be deposited Sept. 17 2021 703 am.

Stimulus check update. How to contact the IRS about 3000 to 3600 Child Tax Credit The IRS has set up three online portals for the 2021 Child Tax Credit that families can use to provide information to the agency and. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return.

Child Tax Credit Irs Mails Letters To Taxpayers About Advanced Payments Wgn Tv

Contact The Irs With Child Tax Credit Problems Here S How Cnet

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

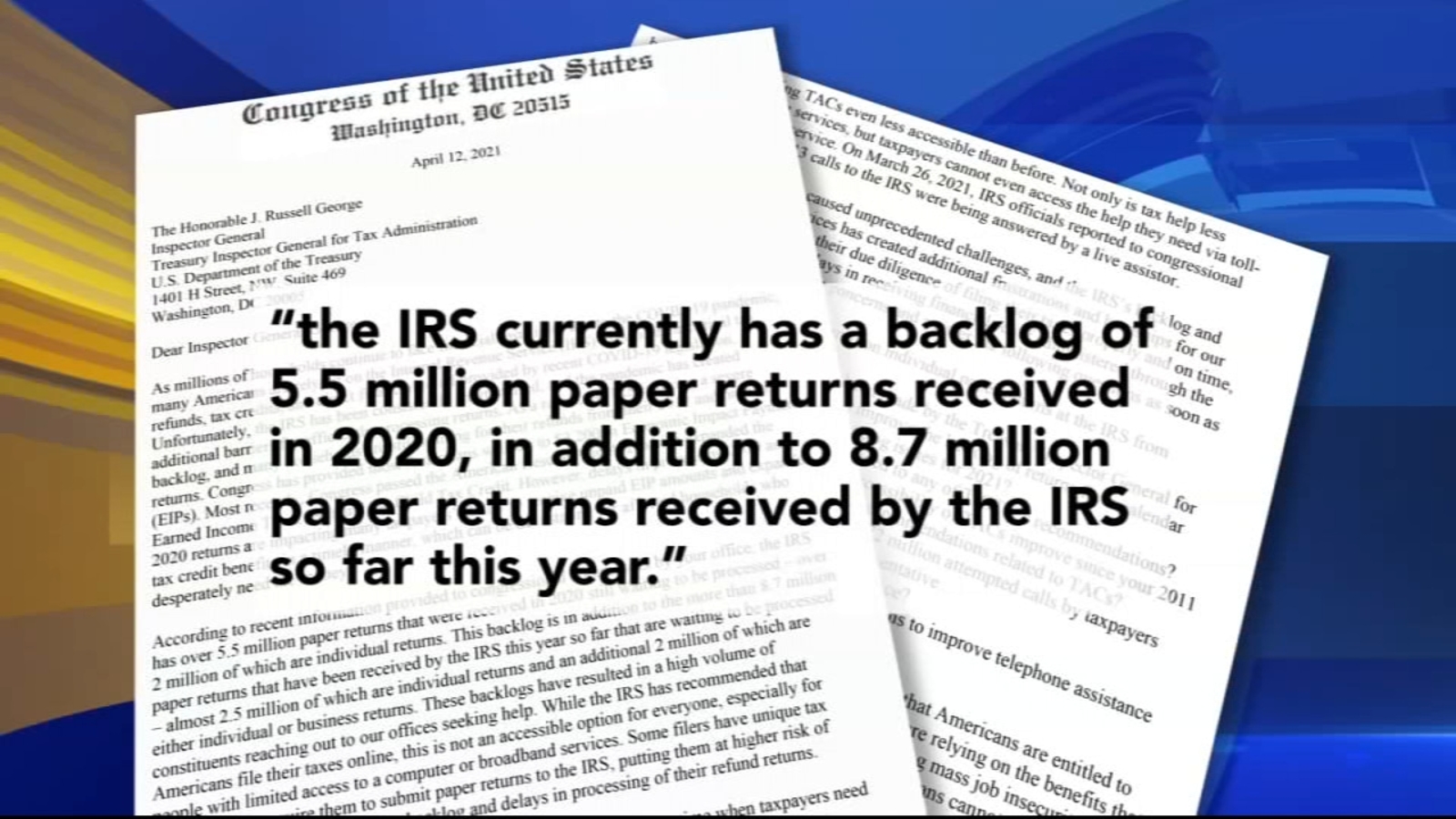

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer Abc7 New York

How Homebuyers Can Prepare For The Potential American Tax Bill Tax Deadline Filing Taxes Tax Season

Here S The Average Irs Tax Refund Amount By State

Will Ordering An Irs Tax Transcript Help Me Find Out When I Ll Get My Refund Or Stimulus Check Aving To Invest

Irs Kicks Off 2020 Tax Filing Season With Returns Due April 15 Help Available On Irs Gov For Fastest Service Eagle Pass Business Journal

Here S The Average Irs Tax Refund Amount By State

Faqs On Tax Returns And The Coronavirus

Irs Experiencing Major Backlog Delays On Tax Refunds 6abc Philadelphia

Irs Child Tax Credit Payments Start July 15

3 11 10 Revenue Receipts Internal Revenue Service

Here S The Average Irs Tax Refund Amount By State

Post a Comment for "Irs Phone Number Nj For Child Tax Credit"