Irs Phone Number Customer Service Child Tax Credit

For all other tax law inquiries visit the Interactive Tax Assistant on irsgov. I filled for a stimulus never received it. Online Tools and Resources.

Third Stimulus And Child Tax Credit Irs Needs Your 2020 Return King5 Com

The Internal Revenue Service has launched two new tools to help families determine their eligibility for the up to 3600-per-child tax credit and to manage their monthly payments which start in.

For questions and answers about Advance Child Tax Credit visit frequently asked questions. Difficulties Reaching the Child Tax Credit Toll-Free Line.

Irs phone number customer service child tax credit. 1 800 829. The main IRS phone number is 800-829-1040 but thats not the only IRS number you can call for help or to speak to a live person. Internal Revenue Service Child Tax Credit IRS CTC IDme Support.

For tax assistance for the deaf and hard of hearing call 1-800-829-4059. The letter included a dedicated phone line to. Choose option 2 for Personal Income Tax instead.

Below are frequently asked questions about the Advance Child Tax Credit Payments in 2021 separated by topic. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. The IRS has their phone lines open from 7am to 7pm.

To qualify for advance payments of the Child Tax Credit you and your spouse if you filed a joint return must have. How to contact the IRS about the 2021 Child Tax Credit Even though families are automatically signed up they may want to change the payment type. 800-829-4933 for businesses with tax-related questions available from 7 am.

Given us your information in 2020 to receive the Economic Impact Payment with the Non-Filers. 800-829-1040 for individuals who have questions about anything related to personal taxes available from 7 am. Individual Income Tax Return Form 1040-SR US.

Next press 3 for all other questions. The Sun 21 total views 1 views today News. It is a tax law resource that takes you through a series of questions and provides you with responses to tax law questions.

Well issue the first advance payment on July 15 2021. Our phone assistors dont have information beyond whats available on IRSgov. We have high call volumes.

IRS customer service representatives are available Monday through Friday 7 am. Local time Monday thru Friday. Taxpayers are also struggling to contact the IRS when they run into problems.

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or. Next press 1 for form tax history or payment. Enter Payment Info Here tool or.

The first question the automated system will ask you is to choose your language. Local time unless otherwise noted. The IRS telephone number is 1-800-829-1040 and they are available from 7 am.

Once youve set your language do NOT choose Option 1 regarding refund info. I never received my child tax credit check. Talk to Us Now.

Tax Return for Seniors or to Form 1040-NR US. Before you call the IRS customer service identify your needs to make the process easy. Attach Schedule 8812 Form 1040 Additional Child Tax Credit to Form 1040 US.

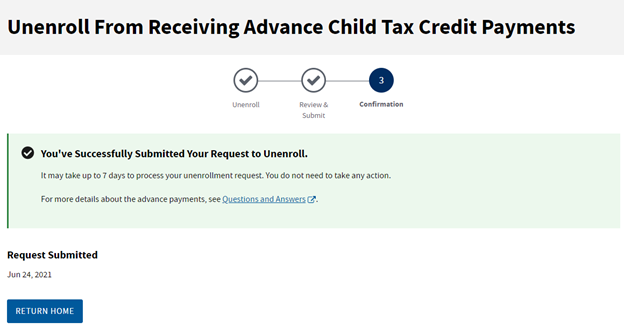

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. Anyone who cannot use the online tool may opt-out of receiving the Advance Child Tax Credit payment by contacting the IRS at 800-908-4184. CBS Philadelphia Advance payments of the new Child Tax Credit start July 15 2021.

The Child Tax Credit Eligibility Assistant can help you determine whether you qualify for the advance child tax credit payments. Nonresident Alien Income Tax Return. The interactive tool is now available in Spanish and other languages.

Do not call the IRS. 888-379-2546 Our concierge is unaffiliated and therefore able to compare deals across many companies Phone Numbers IRS Customer issues Advanced child tax credit deposited i. To be a qualifying child for the child tax credit the child must be a US.

In June the IRS sent Letter 6416 to potentially eligible taxpayers informing them of the upcoming AdvCTC payments and estimating how much CTC they could receive. Child Tax Credit Eligibility Assistant Tool. Use our contact form to let us know.

The toll free number is in the top right hand corner of the Letter 6416 that they received in mid-June. The IRS provides a few toll-free numbers to assist you depending on your circumstance. Special federal IRS phone numbers that can get you to speak to a live person faster.

GetHuman6340189s customer service issue with IRS from July 2021. While the Internal Revenue Service IRS will begin sending out checks on. Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit.

If you suspect you were paid the wrong amount the IRS set up its own Child Tax Credit payment site to verify the potential error. 7am 7pm Local time. The IRS telephone number is 1-800-829-1040.

Ahead of the deadline many people are desperately trying to find out more information by calling the IRS customer service number 1-800-829-1040. The customer service number is. Call now and talk to a real live person who can tell you what promotions you are missing out on.

Read our child tax credit live blog for the latest news and updates Source. Resident alien and must not have attained age 17 by the end of the tax year.

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some Accountants Advise It Wbma

Irs Ctc How Do I Access The Irs Child Tax Credit Update Portal Ctc Up Id Me Support

Question How Can I Actually Talk To Someone At The Irs I Call The Irs Phone Number At 1 800 829 1040 However I Can Never Get An Actua Irs Taxes Irs Tax Debt

Irs Warns Of Child Tax Credit Scams Abc News

Child Tax Credit Where S My Payment What If It S The Wrong Amount

The New 3 600 Child Tax Credit Watch For Two Letters From The Irs Wbff

Irs Child Tax Credit Payments Start July 15

Contact The Irs With Child Tax Credit Problems Here S How Cnet

Does That Irs Letter Bring Good News About Next Month S Child Tax Credit Payment Cnet

Child Tax Credit August Update How To Track It Online Marca

Child Tax Credit Update Irs Launches Two Online Portals

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

2021 Child Tax Credit Advanced Payment Option Tas

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Post a Comment for "Irs Phone Number Customer Service Child Tax Credit"